International Experience

References in short

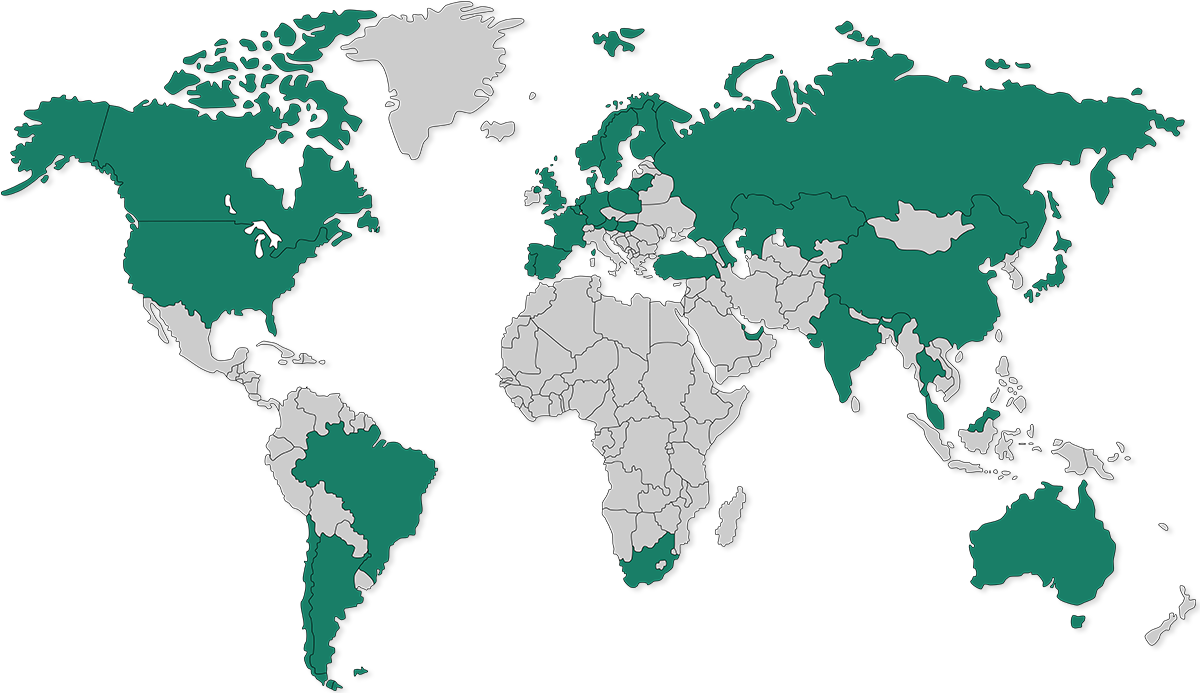

The world map provides an overview of the internationality of expertise. Established contacts to auditors, lawyers and business consultancies with specific local know-how exist in most of these countries.

The short description of substantial projects in the marked countries include a tag for the relevant key emphasis (using W-S-O-R).

Further details on selected projects are available on a supplementary PDF document.

A

|

Argentina (Buenos Aires) |

|

|

Excellent contact to a well-connected business consultancy in Latin America. |

W-S-O-R |

|

Australia (Perth, Brisbane, Gladstone) |

|

| Successful privatisation and 100% takeover of a, until then, listed company through a so-called SCR (Selective Capital Reduction) |

W-S-O-R |

| Support of the local management in the realignment and identification of strategic partners as well as M&A targets |

W-S-O-R |

|

Austria (Vienna) |

|

| Support of the local management in the realignment and reorganisation of the company | W-S-O-R |

|

Azerbaijan (Baku) |

|

| Foundation of the permanent establishment of a Kazakh corporation | W-S-O-R |

B

|

Belgium (Antwerp) |

|

|

Detailed analysis of a large-scale project in Indonesia and related optimisation of project controlling tools |

W-S-O-R |

|

Brazil (Belo Horizonte, Rio de Janeiro) |

|

|

Market study, negotiations with various potential partners, market entry achieved through majority takeover |

W-S-O-R |

C

|

Canada (Calgary, Edmonton, Toronto, Halifax, St. Johns) |

|

|

Market study, partner identification, company evaluation, due diligence, conduct of negotiations (SPA & SHA) with various partners |

W-S-O-R |

|

Implementation of market entry strategy in 3 regions of Canada as well as the establishment of a holding company |

W-S-O-R |

|

Chile (Santiago de Chile) |

|

|

Market entry achieved through majority takeover |

W-S-O-R |

|

China (Shanghai, Beijing, Qingdao, Lanzhou) |

|

|

Search for strategic local partners |

W-S-O-R |

| New establishment of two 100% subsidiaries „WFOE“ |

W-S-O-R |

|

6 years director of the intermediate holding company in Hong Kong |

W-S-O-R |

D

|

Denmark (Fredericia) |

|

|

Expansion of the industrial service to include scaffolding |

W-S-O-R |

F

|

Finland (Helsinki, Turku) |

|

|

Risk analyses & Controlling for large-scale projects (with subsequent turnaround of two identical ships) |

W-S-O-R |

|

Takeover of a competitor in special business segment |

W-S-O-R |

|

France (Paris, Lille) |

|

|

Claim negotiation for a major project in Belgium with Dutch and French participation (D, GB, FR, NL) |

W-S-O-R |

| Takeover of a local competitor in combination with the sale of two companies in Netherlands and Belgium |

W-S-O-R |

G

|

Germany (Bremen, Gelsenkirchen) |

|

|

3 years Head of Accounting and Controlling |

W-S-O-R |

|

2 years Commercial Manager with responsibility for an extensive restructuring and incorporation of the subsidiary (EUR 25 million p.a.) into superordinate group structure |

W-S-O-R |

|

5 years controlling foreign affiliates |

W-S-O-R |

|

10 years strategic business development (international) |

W-S-O-R |

|

Successful sale of an operating company (> EUR 50 million) due to a portfolio adjustment |

W-S-O-R |

|

3 years Managing Director of a trading company (EUR 20 million p.a.) |

W-S-O-R |

|

3 years Managing Director of a construction company (EUR 90 million p.a.) with a considerable improvement of earnings and balance sheet ratios |

W-S-O-R |

|

3 years RFO (Regional Financial Officer) for 6 operating companies in 3 European countries (EUR 140 million p.a.) |

W-S-O-R |

|

Great Britain (Newcastle, Mansfield) |

|

| Market entry through a majority takeover – second phase 100% takeover of a competitor through an earn-out. |

W-S-O-R |

| More than 5 years Director and link to German parent company, realisation of profitable and sustainable growth (from EUR ~25 million to EUR ~100 million p.a.) |

W-S-O-R |

H

|

Hungary (Budapest, Izsák) |

|

| Foundation of a joint venture with a local competitor | W-S-O-R |

I

|

India (New Delhi, Mumbai, Raipur) |

|

|

50% stake in a newly established company with a local partner |

W-S-O-R |

|

Due diligence of a potential manufacturing facility |

W-S-O-R |

J

|

Japan (Tokyo, Kawasaki) |

|

|

Market study, identification of potential partners with initial contact and conduct of negotiations |

W-S-O-R |

K

|

Kazakhstan (Atyrau, Aktau) |

|

|

Talks with potential partners followed by establishment of a 100% subsidiary |

W-S-O-R |

L

|

Lithuania (Vilnius, Kaunas, Klaipeda) |

|

|

Majority stake with 100% takeover at a later stage |

W-S-O-R |

M

|

Malaysia (Kuala Lumpur, Bintulu) |

|

|

Analysis of a large-scale project and organisational processes within the local company |

W-S-O-R |

N

|

Netherlands (Moerdijk) |

|

|

5 years Commercial Manager in a legally independent company |

W-S-O-R |

|

Some years later – 6 months responsibility for restructuring and stabilisation of the company |

W-S-O-R |

|

Ultimately, company sale under a transnational deal across three countries |

W-S-O-R |

|

Norway (Stavanger, Bergen, Moss, Verdal, Trondheim, Hammerfest) |

|

| Majority stake with custom-fit takeover concept for two companies supplementing the service portfolio – followed by a 100% takeover through a put/call option | W-S-O-R |

| Risk analysis and acceptance of an order for a long-term mega-project (EUR ~ 400 million) |

W-S-O-R |

|

Completion of the service range through the takeover of another competitor |

W-S-O-R |

|

5 years Board Member of the principal company (profitable growth from EUR ~30 million to EUR >100 million p.a.) in excess of duration of mega-project |

W-S-O-R |

P

|

Poland (Warsaw, Zabrze, Płock) |

|

|

Excellent contact to a well-connected business consultancy in Eastern Europe |

W-S-O-R |

|

Majority takeover of several competitors with subsequent consolidation and transfer into a 100% subsidiary |

W-S-O-R |

|

Portugal (Lisbon) |

|

|

Instead of the planned majority takeover a strategic alliance in a niche market was agreed |

W-S-O-R |

Q

|

Qatar (Doha) |

|

|

Joint venture in the offshore sector |

W-S-O-R |

R

|

Russia (Moscow) |

|

|

Support of the regional management in conducting negotiations to establish a joint venture |

W-S-O-R |

S

|

Singapore |

|

|

Expansion of the service portfolio through a majority takeover |

W-S-O-R |

|

South Africa (Johannesburg) |

|

| Discussion of specifics of the South African market as part of an international management meeting, i.e. Black Economic Empowerment (BEE) | W-S-O-R |

|

Spain (Bilbao) |

|

|

Support of the local management in controlling issues |

W-S-O-R |

| Diversification through the takeover of adjacent trades |

W-S-O-R |

|

Sweden (Gothenburg) |

|

|

Support of the local management in controlling issues |

W-S-O-R |

T

|

Thailand (Rayong) |

|

|

Market exploration and management discussions |

W-S-O-R |

|

Turkey (Istanbul, Kayseri) |

|

|

Attempted majority takeover of an industrial service provider and a production facility |

W-S-O-R |

U

|

United Arab Emirates (Abu Dhabi, Dubai) |

|

|

Negotiations on a majority takeover in the marine & offshore sector |

W-S-O-R |

|

United Kingdom of Great Britain and Northern Ireland |

|

|

United States (New York, Chicago) |

|

|

Talks on potential takeovers as well as realisation of a joint venture in a niche market |

W-S-O-R |